Volume Profile Trading: Trading Imbalances and Traps

Profiting from the market's imbalances and avoiding the traps, or possibly being a part of the trap.

Welcome everyone to another lesson on Volume Profile trading. If you haven’t already be sure to check out our first Volume Profile lesson to brush up on the basics.

In this lesson I will be discussing the two most common imbalanced profiles, the “P” shaped profile and the “b” Shaped Profile. These profile types are extremely important for identifying trend shifts and where significant buyer/seller demand is located. These profiles offer great reversal trades, sweeps, long lasting trailing trades, traps, and more. In this lesson I will showcase what to look for and the typical trades I like to take on these days.

Lets get started.

To begin I need to first discuss what makes a P shape or b shape imbalanced. These types of days have similar nodes to a D shape day, but their nodes are not in the middle of the day, they are near the high or low of day. They also have a very one sided tail structure, P shape days have a very long lower tail, but a short upper tail, vice versa for b shape days. On P shape days the imbalance leans bullish, due to the value resting on the high, b shape days lean bearish because the value is resting on the low.

These imbalances give the trader unique trading opportunities. Let’s cover some of these trade examples;

P Shape Profile: A P shape profile is a profile that has a major node towards the high of day then the remaining volume is spread very thin below the POC node at the top. This creates a long tail on the middle and low of day with the POC and Value Area towards the high of day. These days are known as "Shorts Covering" and can typically lead to continuation and strong breakouts on the following days. They are inherently bullish. A typical trade would be longing once price holds above the POC and targeting previous Value levels above.

A typical trade would be longing a break and hold above the POC of the P shape and targeting previous value levels. The stop should be placed below the POC node and any significant support nearby.

Another typical trade can look like this. If there is no previous value to target above you (price is hitting all time highs) then you have to use a Fibonacci tool to find targets. The Fib should be drawn from the low of day to the high of day, unless it is very choppy then the Fib should be drawn from the low of the major impulse to the high of the impulse. Then it will give you our Fib targets, -0.5 and -0.618. (if you are unfamiliar with Fibonacci watch this video click here)

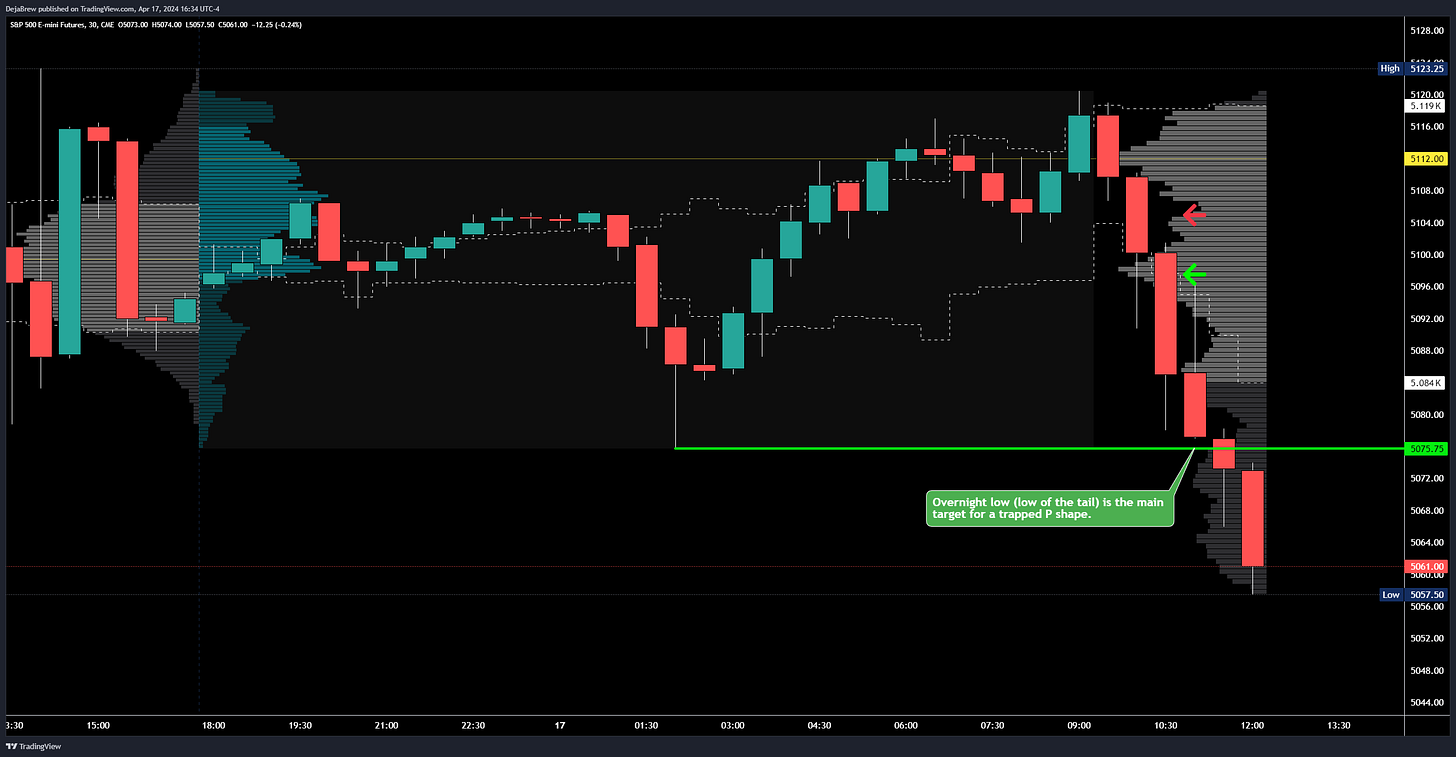

P Shape Profile Trapped: A P shape is typically bullish for the following day, but it is bullish from shorts covering, not always new longs opening. Being bullish from shorts getting out and being bullish due to a strong buyer demand is very different and this is the key concept in trapping a P shape profile. A P Shape fails when the POC is lost, as long as the POC node holds as support the trader can anticipate higher prices, but once failed the price will look for old value. The first value target would the the P shape day's VAL.

A typical trade would be shorting once the POC node is lost or retested as resistance. The stop would be placed above the POC node or major resistance nodes above. The targets would be previous value levels below.

These examples showcase a P Shape being trapped on the following trading day, there can also be a strong P shape trap on the same day the P shape is forming.

P Shape Trapped (Same Day): In this example the P shape is trapped the same day due to a lack of buyers on the open. Once the POC node and VAL are lost it can begin a squeeze downward based on how many buyers are stuck on the high. The more buyers that are trapped on the failed breakout the stronger the squeeze will be.

A typical trade would be selling once the VAL was lost with significant sell pressure or retraced into then sold. This entry can be dangerous because buying the VAL on a standard P shaped day is very bullish, so for the trap to play out you don’t want to see any buy pressure on the VAL, it needs to be lost easily. The standard target is the low of day. The stop should be placed above a resistance node close to the VAL entry.

The VAL was shifting rapidly in this example, it is shown as the dotted white line. The VAL to use for the entry is always the current VAL when price is breaking it.

P Shape Tail Extension: A P shape tail extension is a trade that requires a closed tail, meaning this trade isn’t taken using the active profile that is still developing. Typically you would use the Pre-Market profile that has closed as a P shape or a previous trading day that has closed as a P shape. In this example we use a full trading session that closed as a P shape profile.

The way to find the target for this extension is finding the length of the lower tail in points. Then you extend the upper tail by that many points by starting at the VAH.

The typical long trade would be taken once value holds above the VAH, the same way you would take a P shape breakout trade. The target would be the tail imbalance. The stop would be placed below a support node. Preferably this would be happening within the same day as the overnight profile being grabbed or the next trading day. In this example it takes two trading days to play out.

Now that we have discussed D shape and P shape profiles let’s discuss b shape profiles.

b Shape Profile: A b Shape Profile is when the majority of the volume is traded towards the low of the day with very limited volume towards the high. This type of profile is known as "Longs Closing" because it is mainly due to short term longs taking profits or exiting their trades and not due to many long term investors entering shorts. These days are typically bearish and can lead to a continuation to the downside if their POC is held as resistance.

A typical trade would be shorting once price holds below the POC and targeting lower Value levels. The stop would be placed above key resistance nodes above, but not too far because it will lower your Risk to Reward.

b Shape Profile Trapped: In some cases a b shape profile will not lead to a continuation move down and it will lead to further balancing. If the b shape profile sees an end of day rally and closes towards or above the daily open it is no longer a bearish day because its POC is not being held as resistance.

A typical trade would be longing the retest of the POC or Value Area Levels as support and targeting previous value levels above. In this example I show how you can also target strong volume nodes, these nodes will act as strong magnets.

A typical trade can also look like longing the retest of the Value Area High with your stop below a support node. In this example I show that you can target the daily open above your entry as well. This example gets stopped out before hitting its targets.

b Shape Tail Extension: A b shape tail extension is a trade that requires a closed tail, meaning this trade isn’t taken using the active profile that is still developing. Typically you would use the Pre-Market profile that has closed as a b shape or a previous trading day that has closed as a b shape. In this example we use a full trading session that closed as a b shape profile. The way to find the target for this extension is finding the length of the upper tail in points. Then you extend the lower tail by that many points by starting at the VAL.

A typical trade would be an short entry once value holds below the VAL. The target would be the tail imbalance. The stop would be placed above a resistance node, preferably the POC if it is close enough.

That is all for this lesson, thank you for reading this far and if you have any questions please feel free to leave a comment and I will get to it as soon as possible. I will have more lessons coming out soon on the other profile shapes and how to trade them.

Very nice explanation of VP and very helpful. Am I receiving these email because I paid for a 1 month subscription or do they get sent to everyone? If non payers are getting them; what is advantage of me paying for subscription?

loving the format, easy to follow thx deja